Hey friends,

There are three primary asset classes in a diversified portfolio - cash, stocks, and bonds.

While many people have a general understanding of stocks and cash, bonds tend to be less familiar territory.

In today’s newsletter, I will help you understand what bonds are, as well as why individual investors should care about them. So let’s dive right into it.

(Note: If you want to learn more about stocks, I suggest you read my previous newsletter on them)

“We recommended that the investor divide his holdings between high-grade bonds and leading common stocks”

—Ben Graham, The Intelligent Investor

Bonds are debt securities that provide a fixed income stream to investors

Bonds are loans made between a borrower and lender.

They are issued (or sold) by the federal government, corporations, municipalities, and government-affiliated agencies to raise capital (borrow money) for special projects and operations.

Bonds are then bought by investors (lenders), who provide capital in exchange for a stream of interest payments based on a predetermined schedule.

Bondholders are creditors to issuers. Unlike stocks, which represent ownership in a company, bonds are a form of debt.

While stockholders care about the valuation of a business, bondholders care about an issuer’s creditworthiness. This determines how likely they are to receive their interest payments and have their principal returned (the amount you invested).

How bonds pay you

There are 3 main facets of a bond that you need to understand:

Par Value (also called “face value” or “nominal value”): The principal amount of a bond, which is usually $100 or $1,000.

Coupon Rate: The stated rate of interest that a bond will pay you. Coupon payments can be made quarterly, semi-annually, annually, etc.

Maturity Date: When the issuer will pay the par value (principal) back to a bondholder.

Let’s use an overly simplified example to display how they work.

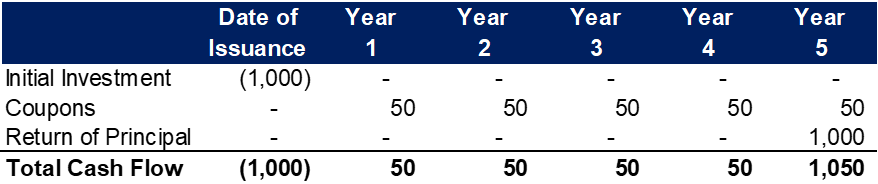

Assume that Apple issued a bond with a $1,000 par value, a 5% coupon rate paid annually, and it matures in 5 years.

The image below shows you how cash flows will occur over the life of the bond:

Notice that the bonds provide a fixed income stream of coupon payments over a pre-determined timeframe. This is a key differentiator from stocks, whose returns are more volatile and less predictable.

Bonds are a tool you can use to generate income and invest towards your financial goals

Compared to stocks, bonds have a more limited risk and reward profile.

They diversify your holdings, lower your portfolio’s risk, and can potentially increase your overall returns in years when the stock market declines.

Given that bond returns are stable and predictable, they are also easy to match to your liabilities. For example, if you know your expenses are $1,000 per month… you can easily identify that $240k of bonds with a 5% coupon will provide $12k per year, enough to meet your monthly obligations.

Bond yields

Yields are the return on investment expected from holding a bond.

A bond’s return is tied to interest payments, the return of principal at maturity, and potential price appreciation depending on when you buy or sell it.

While stocks are higher risk with unlimited upside potential, bonds are generally lower risk and have a limited upside potential.

There are 3 primary measures of yield that you should be aware of:

Current yield: Annual coupon divided by the bond’s market price

Yield to Maturity (YTM): The internal rate of return (IRR) of all cash flows from a bond. It assumes that all coupons will be reinvested at the same YTM and that you will hold a bond to maturity

Real yield: Nominal yield less inflation (either actual or expected inflation rates)

Bond pricing

If there is one thing you remember about bonds, it should be this: bond prices have an inverse relationship with interest rates.

As interest rates rise, bond prices will go down, and vice versa.

The price you pay for a bond, however, depends on when you buy it.

If you buy it at issuance, you will likely pay the par value. If you buy it in the secondary market after its issuance, you will pay the market price of the bond.

The market price of a bond may be higher or lower than its par value depending on changes to an issuer’s creditworthiness, interest rates, or other factors.

The different types of bonds

Below is a short overview of the most common bonds you will come across:

Treasuries

Bonds issued by the U.S. Department of Treasury (federal government) that have maturities ranging from 3 months to 30 years.

Treasury Inflation-Protected Securities (TIPS) are a special type of bond that protects investors from inflation. The principal value of TIPS adjusts based on changes to the Consumer Price Index (CPI), a measure of inflation. The coupon rate is applied to the adjusted principal amount every 6 months.

“TIPS… rise in value if the Consumer Price Index goes up, effectively immunizing the investor against losing money after inflation. Stocks carry no such guarantee and… are a relatively poor hedge against high rates of inflation”

—Jason Zweig, The Intelligent Investor

Treasury bonds are considered “risk-free” assets because they are backed by the “full faith and credit” of the U.S. government. Given the government can print money and raise taxes, there is a high level of confidence in its ability to meet its debt obligations.

Treasuries are exempt from state and local income taxes but are subject to federal income tax.

Corporate bonds

Bonds issued by corporations. There are 2 primary categories of them:

Investment grade: Bonds from issuers with high perceived creditworthiness. They are generally safer than other corporate bond issues and provide a higher yield than treasuries.

High-Yield (or “junk” bonds): Due to the higher risk associated with these bonds, investors are compensated with higher yields than investment grade.

Moody’s, Standard & Poor’s, and Fitch are the “big three” Credit Rating Agencies that determine if a bond is investment grade or junk. Below is an image that displays investment grade vs junk bond ratings by agency (image courtesy of the Corporate Finance Institute)

Municipal bonds (“munis”)

Municipal bonds, often referred to as "munis," are issued by state and local governments, municipalities, or their agencies. These bonds finance various public initiatives, such as building schools, highways, or water treatment facilities.

They are generally considered low-risk, as they are backed by the taxing power of the issuing municipality… but the financial health of every municipality varies.

The interest income from munis is often exempt from federal income tax. If an investor lives in the state where the bond is issued, the interest may also be exempt from state and local taxes.

Agency bonds

Agency bonds are issued by government-sponsored entities (GSEs) or federal agencies, which are entities created by the U.S. government that operate independently.

Agency bonds combine the credit quality of U.S. Treasuries with slightly higher yields, making them a potentially attractive investment.

Examples of agencies include Fannie Mae (Federal National Mortgage Association), Freddie Mac (Federal Home Loan Mortgage Corporation), and Ginnie Mae (Government National Mortgage Association).

Where to buy bonds

Most bonds trade in over-the-counter (OTC) markets, meaning they aren’t listed on an organized exchange like the NYSE or NASDAQ.

Many online and traditional brokerage firms provide platforms for buying and selling bonds, including treasuries, munis, corporates, and other issues.

There are also index ETFs that provide exposure to the entire bond market, including Vanguard’s BND or BlackRock’s AGG funds.

You can also buy bonds directly from the issuers. This is most common with treasuries, which can be bought from treasurydirect.gov.

The risks of bonds

There is no free lunch in the investing game. When it comes to bonds, you need to be aware of the key risks:

Inflation: If inflation rises more than expected, the purchasing power of the future interest and principal payments from a bond may be eroded

Default risk: Impacts the ability to receive your interest payments and have your principal returned

Reinvestment risk: When the interest or principal payments received from a bond must be reinvested at lower rates. This is important because your Yield to Maturity (YTM) assumes coupons get reinvested at the same YTM

Interest rate risk: When interest rates rise, bond prices generally fall. This risk is relevant to existing bondholders in a changing interest rate environment

Conclusion

Bonds play an important role in the world of finance, offering investors a reliable source of fixed income and providing issuers with a means to raise capital.

While both stocks and bonds are investment vehicles, bonds involve lending money for interest payments rather than ownership in a company.

The diverse types of bonds, including government, municipal, and corporate bonds, cater to various risk profiles and investment goals.

While bonds are generally considered lower risk than stocks, it is important to note that they are not always less risky.

Understanding the basics of bonds is essential for investors looking to build a well-balanced and diversified investment portfolio.

That’s all for today - thank you for taking the time to read!

Subscribe to "The Asset Column" to have future publications delivered straight to your email inbox.

Follow TAC on 𝕏 (Twitter), where we post daily content about personal finance, investing, and entrepreneurship.

Refer to the disclaimer on our “About” page.